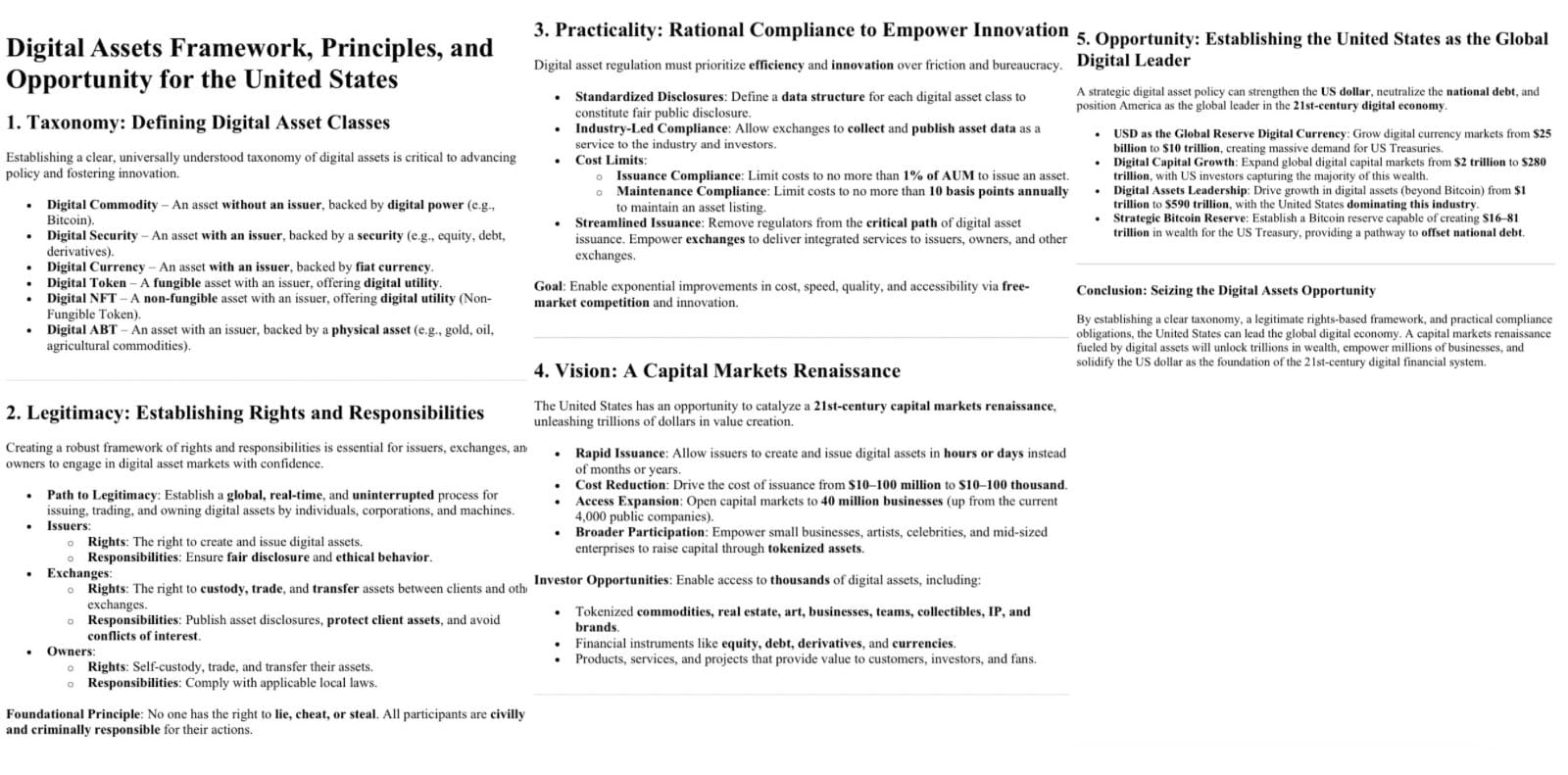

Digital Assets Framework, Principles, and Opportunity for the United States

1. Taxonomy: Defining Digital Asset Classes

Establishing a clear, universally understood taxonomy of digital assets is critical to advancing policy and fostering innovation.

- Digital Commodity — An asset without an issuer, backed by digital power (e.g., Bitcoin).

- Digital Security — An asset with an issuer, backed by a security (e.g., equity, debt, derivatives).

- Digital Currency — An asset with an issuer, backed by fiat currency.

- Digital Token — A fungible asset with an issuer, offering digital utility.

- Digital NFT — A non-fungible asset with an issuer, offering digital utility (Non-Fungible Token).

- Digital ABT — An asset with an issuer, backed by a physical asset (e.g., gold, oil, agricultural commodities).

2. Legitimacy: Establishing Rights and Responsibilities

Creating a robust framework of rights and responsibilities is essential for issuers, exchanges, and owners to engage in digital asset markets with confidence.

- Path to Legitimacy: Establish a global, real-time, and uninterrupted process for issuing, trading, and owning digital assets by individuals, corporations, and machines.

- Issuers:

- Rights: The right to create and issue digital assets.

- Responsibilities: Ensure fair disclosure and ethical behavior.

- Exchanges:

- Rights: The right to custody, trade, and transfer assets between clients and other exchanges.

- Responsibilities: Publish asset disclosures, protect client assets, and avoid conflicts of interest.

- Owners:

- Rights: Self-custody, trade, and transfer their assets.

- Responsibilities: Comply with applicable local laws.

Foundational Principle:

No one has the right to lie, cheat, or steal. All participants are civilly and criminally responsible for their actions.

3. Practicality: Rational Compliance to Empower Innovation

Digital asset regulation must prioritize efficiency and innovation over friction and bureaucracy.

- Standardized Disclosures: Define a data structure for each digital asset class to constitute fair public disclosure.

- Industry-Led Compliance: Allow exchanges to collect and publish asset data as a service to the industry and investors.

- Cost Limits:

- Issuance Compliance: Limit costs to no more than 1% of AUM to issue an asset.

- Maintenance Compliance: Limit costs to no more than 10 basis points annually to maintain an asset listing.

- Streamlined Issuance: Remove regulators from the critical path of digital asset issuance. Empower exchanges to deliver integrated services to issuers, owners, and other exchanges.

Goal:

Enable exponential improvements in cost, speed, quality, and accessibility via free-market competition and innovation.

4. Vision: A Capital Markets Renaissance

The United States has an opportunity to catalyze a 21st-century capital markets renaissance, unleashing trillions of dollars in value creation.

- Rapid Issuance: Allow issuers to create and issue digital assets in hours or days instead of months or years.

- Cost Reduction: Drive the cost of issuance from $10–100 million to $10–100 thousand.

- Access Expansion: Open capital markets to 40 million businesses (up from the current 4,000 public companies).

- Broader Participation: Empower small businesses, artists, celebrities, and mid-sized enterprises to raise capital through tokenized assets.

Investor Opportunities:

Enable access to thousands of digital assets, including:

- Tokenized commodities, real estate, art, businesses, teams, collectibles, IP, and brands.

- Financial instruments like equity, debt, derivatives, and currencies.

- Products, services, and projects that provide value to customers, investors, and fans.

5. Condition Setting: The Digital Asset Opportunity

A strategic digital asset policy can strengthen the US dollar, neutralize the national debt, and position America as the global leader in the 21st-century digital economy.

- USD as the Global Reserve Digital Currency: Grow digital currency markets from $25 billion to $10 trillion, creating massive demand for US Treasuries.

- Digital Capital Growth: Expand global digital capital markets from $2 trillion to $280 trillion, with US investors capturing the majority of this wealth.

- Digital Assets Leadership: Drive growth in digital assets (beyond Bitcoin) from $1 trillion to $590 trillion, with the United States dominating this industry.

- Strategic Bitcoin Reserve: Establish a Bitcoin reserve capable of creating $16–81 trillion in wealth for the US Treasury, providing a pathway to offset national debt.

Conclusion

By establishing a clear taxonomy, a legitimate rights-based framework, and practical compliance obligations, the United States can lead the global digital economy. A capital markets renaissance fueled by digital assets will unlock trillions in wealth, empower millions of businesses, and solidify the US dollar as the foundation of the 21st-century digital financial system.