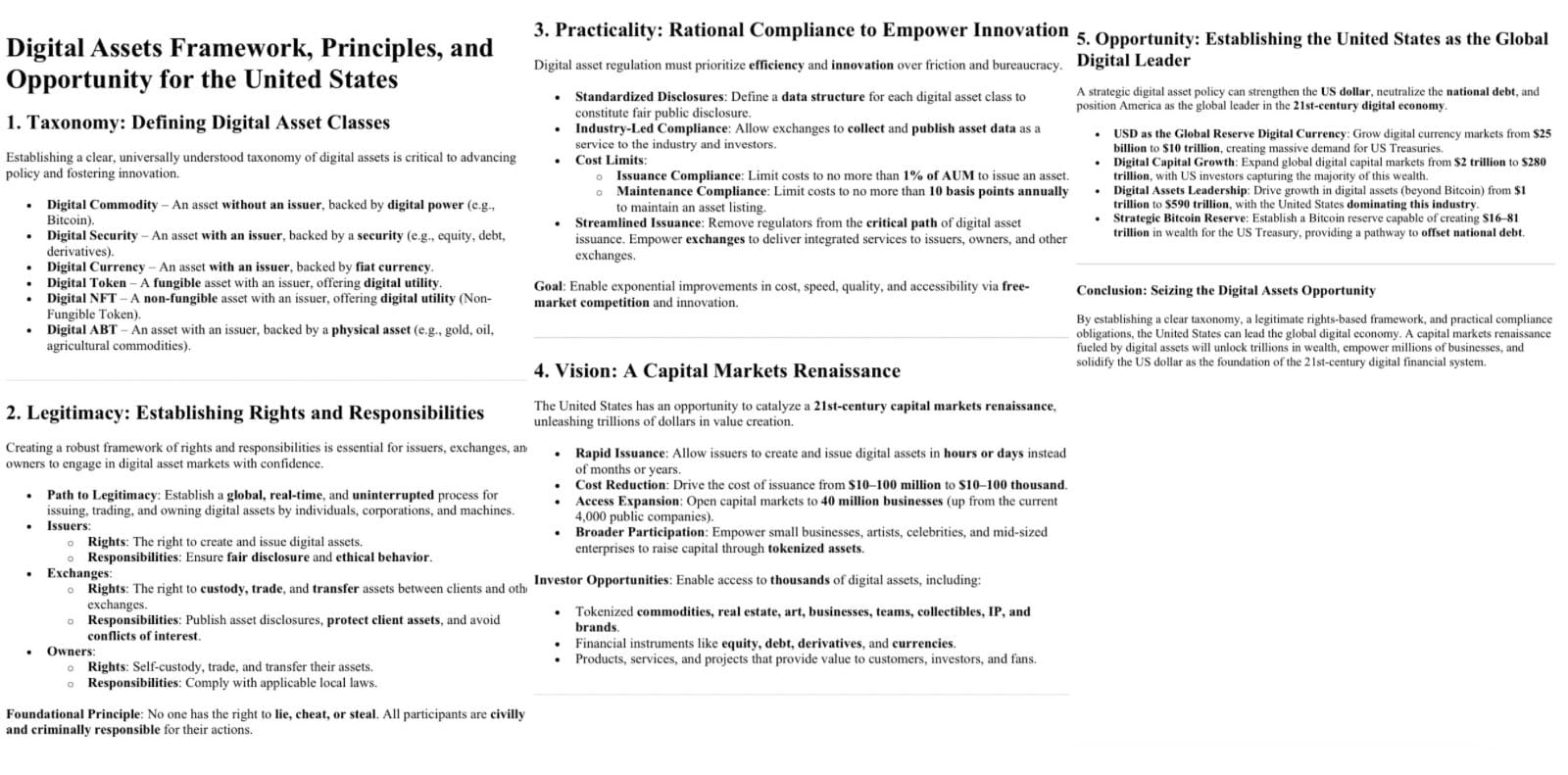

May 28, 2025 – The world of corporate finance just witnessed a seismic shift as GameStop Corp. (NYSE: GME), the video game retailer once at the heart of the 2021 meme-stock frenzy, announced its purchase of 4,710 Bitcoin (BTC). Valued at over $513 million USD, this move marks GameStop’s first foray into cryptocurrency, reflecting a broader trend of global Bitcoin adoption among corporations. In this article, we’ll explore the significance of GameStop’s investment, its implications for the company and the market, and how it fits into the global landscape of Bitcoin adoption, backed by the latest statistics.

To finance this BTC purchase, GameStop relied on a $1.3 billion dollar raise via convertible bonds, signalling new corporate strategy.

GameStop’s Bitcoin Acquisition: The Details

On May 28, 2025, GameStop announced via a Business Wire press release that it had acquired 4,710 Bitcoin. At the time of purchase, Bitcoin’s price hovered around $108,917 per BTC (based on the $513 million valuation of the purchase, as reported by Reuters). This acquisition represents a strategic pivot for GameStop, which has been grappling with a declining brick-and-mortar business model in the face of digital gaming trends. According to historical data, GameStop’s physical game sales dropped by 16.4% during the 2016 holiday season, a trend that has only intensified with the rise of digital downloads and streaming platforms.

GameStop’s market capitalization as of May 28, 2025, stands at approximately $10.2 billion, based on recent financial reports and stock price trends. With cash, cash equivalents, and marketable securities totaling $4.78 billion as of February 2025 (per Reuters), the $513 million Bitcoin purchase represents roughly 10.7% of its liquid assets and about 5% of its market cap. This is a significant allocation for a company of GameStop’s size, signaling strong confidence in Bitcoin as a long-term asset.

To put GameStop’s Bitcoin holdings in context, let’s compare them to the largest corporate holder of Bitcoin, MicroStrategy (MSTR). As of early 2025, MicroStrategy holds approximately 252,220 BTC, valued at over $27 billion at current prices, according to public filings. While GameStop’s 4,710 BTC is a fraction of MicroStrategy’s stash, it still positions GameStop as a notable player among corporate Bitcoin adopters. For reference, if Bitcoin’s market cap is $2.15 trillion (based on a circulating supply of 19.76 million BTC as of May 2025, per YCharts), GameStop’s holdings represent about 0.024% of all Bitcoin in existence—a modest but meaningful stake.

Why GameStop’s Move Matters

GameStop’s CEO, Ryan Cohen, has framed the Bitcoin purchase as a hedge against global currency devaluation, a sentiment echoed by other corporate leaders like MicroStrategy’s Michael Saylor. In a statement accompanying the announcement, Cohen emphasized Bitcoin’s advantages over traditional assets like gold, citing its decentralized nature and finite supply. This move comes at a time when Bitcoin’s price has surged, reaching $107,768.73 on May 27, 2025, according to Coinbase data, though it recently pulled back from a peak of $110,000 amid speculative trading.

The announcement triggered volatility in GameStop’s stock, which saw a 4.4% rise in pre-market trading on May 28, 2025, but later declined as the market digested the news (per Reuters).

GameStop’s entry into Bitcoin follows a broader trend of corporate adoption, pioneered by companies like MicroStrategy and Tesla. MicroStrategy began accumulating Bitcoin in 2020, and Tesla invested $1.5 billion in 2021, briefly accepting BTC for vehicle purchases. GameStop’s more cautious approach—allocating a smaller percentage of its assets compared to MicroStrategy’s “all-in” strategy—still aligns with this growing confidence in Bitcoin as a treasury reserve asset. As noted in a Trust Wallet article from April 2025, such moves legitimize cryptocurrency in the eyes of traditional investors, potentially driving broader adoption across industries.

Global Bitcoin Adoption: The Bigger Picture

GameStop’s investment comes amid a global surge in Bitcoin adoption, both at the individual and institutional levels. According to the 2022 Global Cryptocurrency Adoption Index by BuyBitcoinWorldwide, the global crypto ownership rate stands at 15%, with the U.S. slightly below at 13%. This translates to 33.7 million Americans owning cryptocurrency, of which 77% hold Bitcoin, per a 2023 report cited in the same study. Globally, Bitcoin remains the most widely owned cryptocurrency, with 37% of crypto owners holding BTC, though regional variations exist—60% of crypto owners in Australia hold Bitcoin, compared to 21% in Mexico.

The U.S. leads in Bitcoin trading volume, with approximately $1.5 billion in daily BTC trades as of 2022 (BuyBitcoinWorldwide). This dominance underscores the U.S.’s role as a hub for cryptocurrency activity, making GameStop’s move particularly resonant for American retail investors. Demographically, U.S. crypto ownership skews toward younger, male investors: 74% of crypto owners are men, and 61% are aged 18–34, while those over 55 make up just 9% of owners.

Globally, the 2023 Chainalysis Global Crypto Adoption Index highlights Central and Southern Asia as leaders in grassroots crypto adoption, with India boasting a 29% crypto ownership rate—the highest worldwide. Germany, by contrast, lags at 6%. These disparities reflect varying levels of economic incentives, regulatory environments, and technological access, all of which influence Bitcoin’s global footprint.

Implications for GameStop and the Crypto Market

For GameStop, the Bitcoin purchase is a bold attempt to reinvent itself amid a challenging business landscape. The company, headquartered in Grapevine, Texas, has struggled to adapt to the digital age, with its core business of selling physical video games through retail stores becoming increasingly obsolete. By diversifying into Bitcoin, GameStop aims to attract investor interest and capitalize on the growing mainstream acceptance of cryptocurrencies, especially following events like the November 2024 U.S. election, which saw Bitcoin prices soar amid pro-crypto sentiment (per Fortune).

However, the move is not without risks. Bitcoin’s volatility remains a concern—its price dropped from $110,000 to $107,768.73 in the days leading up to GameStop’s announcement, and historical data shows even sharper corrections. X users like

@JoeNakamoto urged GameStop to provide proof of reserves and avoid storing its BTC on centralized exchanges like Coinbase, reflecting broader concerns about security and transparency in corporate crypto holdings.

For the broader crypto market, GameStop’s investment could inspire other mid-sized companies to explore Bitcoin as a treasury asset, further legitimizing its role in corporate finance.

A New Chapter for Bitcoin Adoption

GameStop’s purchase of 4,710 Bitcoin, valued at $513 million, marks a pivotal moment in the intersection of corporate finance and cryptocurrency. For a company with a $10.2 billion market cap and $4.78 billion in liquid assets, this investment is a significant bet on Bitcoin’s future, reflecting both strategic foresight and a willingness to embrace risk. It also underscores the growing global adoption of Bitcoin, which now boasts a 15% ownership rate worldwide and a $2.15 trillion market cap.

As corporations like GameStop, MicroStrategy, and Tesla continue to integrate Bitcoin into their financial strategies, the cryptocurrency’s role as a mainstream asset becomes increasingly undeniable. However, challenges like volatility, regulatory scrutiny, and security concerns remain. For now, GameStop’s move has sparked both excitement and debate, setting the stage for a new chapter in the evolving story of Bitcoin’s global adoption.